Brilliant Tips About How To Reduce Tax Bracket

Government officials did not specify which income levels would qualify for the new rates,.

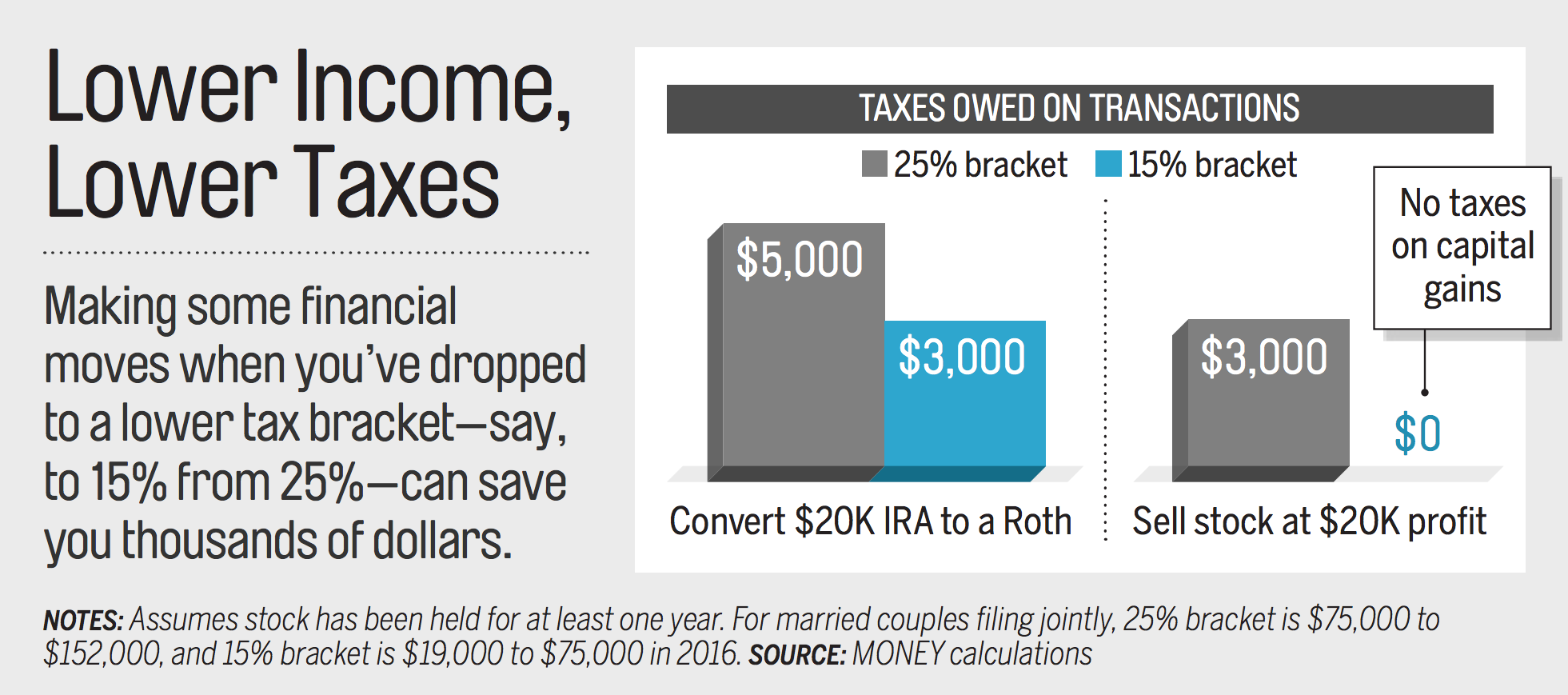

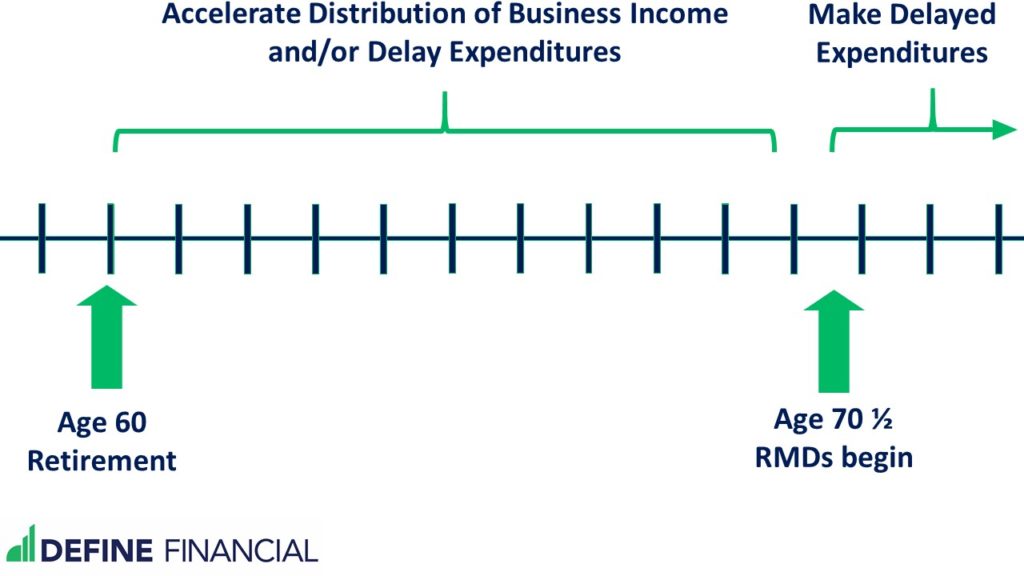

How to reduce tax bracket. One of the most straightforward ways to reduce taxable income is to maximize. Any money made after this point gets taxed at 40%. Contribute to a retirement account retirement account contributions are one of the easiest ways how to reduce taxable income, and it’s a strategy that can be used by almost.

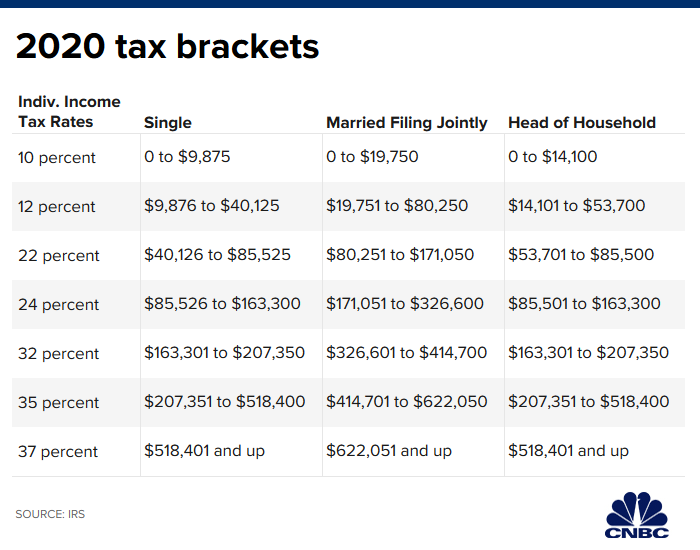

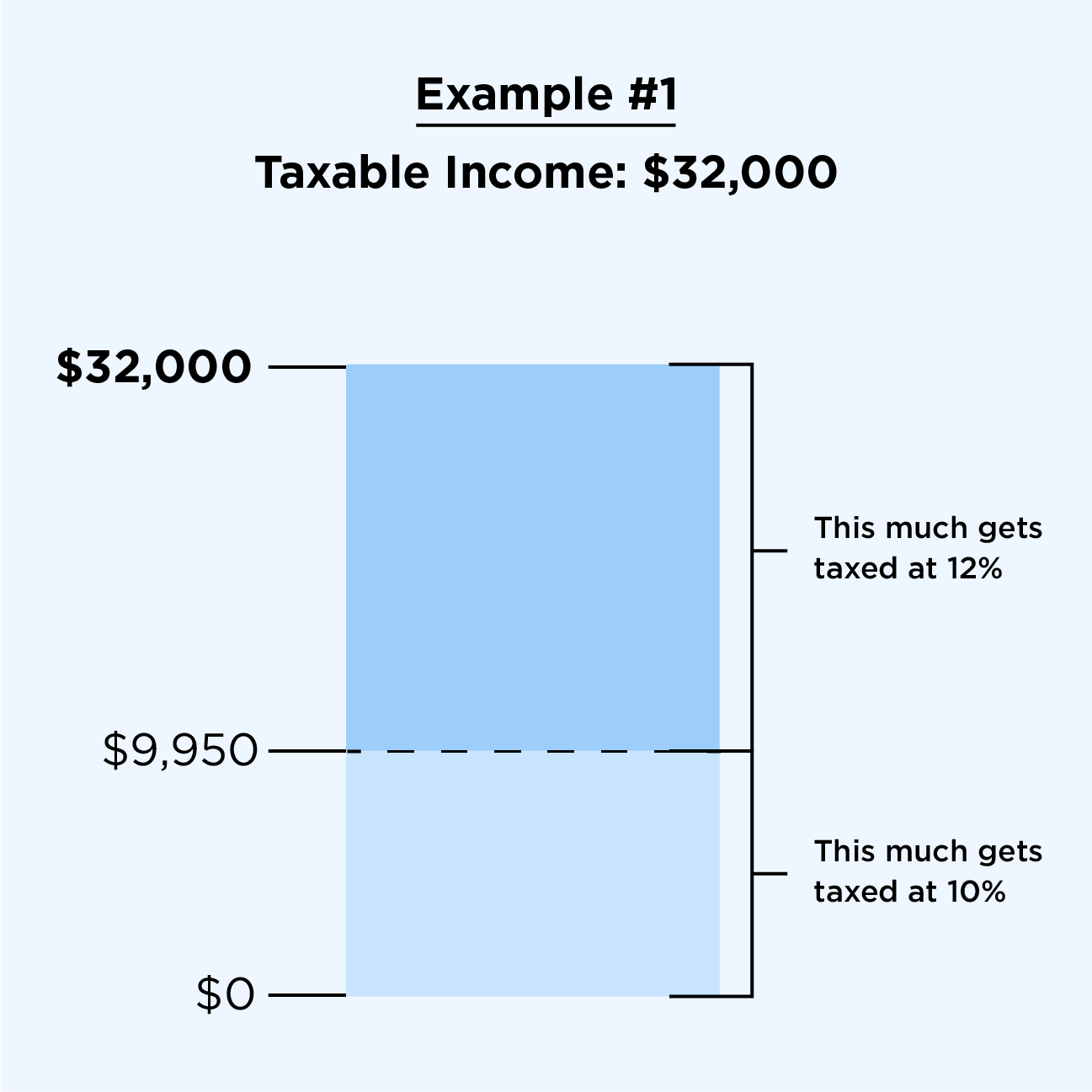

In our example above, the effective tax rates calculation for john. Certain types of income aren’t subject to income tax at all. If you add the taxes chet should pay based on his tax.

Less taxable income means less tax, and 401 (k)s are a popular way to reduce tax bills. A married couple, or civil partnership, with only one income, pays an income tax of 20% on earnings up to €45,800. “but understanding the makeup and.

For 2021, you could have. Tie the knot with another taxpayer. Certain types of income aren’t subject to income tax at all.

The irs doesn’t tax what you divert directly from your paycheck into a 401 (k). Take advantage of tax credits. Take advantage of tax credits.

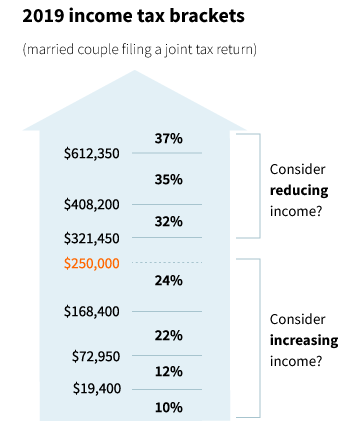

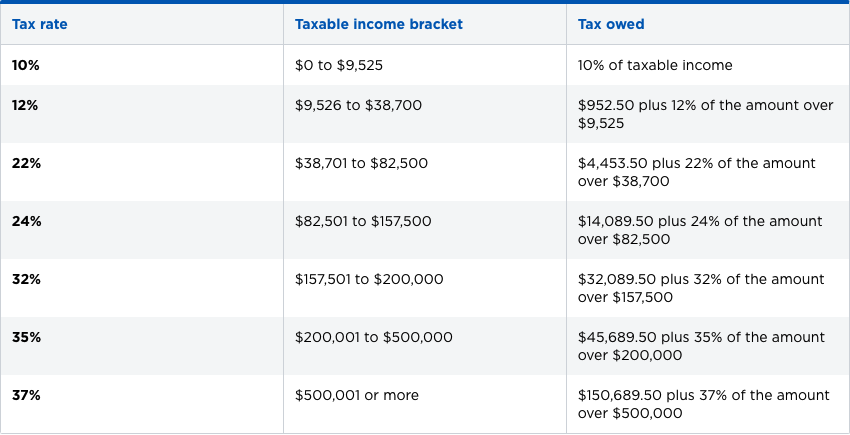

How to reduce your income tax bracket? Here are 10 options that can help lower your tax bracket: The current brackets tax individuals at fixed rates of 10%, 15%, 25%, 28%, 33% and 35%.